Africa's Top Product Exports and Destinations

February 2024

Research

Trade

Overview

Africa's international trade landscape presents a dynamic tapestry of opportunities shaped by its rich array of natural resources, agricultural abundance, and burgeoning manufacturing sectors. Over the years, with the support of foreign production knowledge combined with open policies by many local governments in Africa, the increase of GDP per capita in products and services is a strong evidence of all these investments.

Africa has been demonstrating steady growth in export activities, with key mineral commodities such as gold, diamonds, petroleum products and other natural resources. Agricultural staples such as cocoa, coffee, cotton, and tea are also being recognized in the global trade market. The production chains of mineral and agricultural products have long been established with the use of machines and technologies run by the young and energetic workforce.

Besides, the growing emphasis on the export of manufactured goods, particularly textiles, machinery and electronics, is highlighting the continent's efforts to diversify its export bases and ascend the value chain. There is a noticeable increase of labor shifting to work from agricultural to industrial fields, as to meet the increasing demand of urban development, this new labor force is also equipped to take crucial roles in infrastructure and engineering projects.

Growth

Africa's thriving export dynamics reveal a nuanced picture shaped by multiple factors. From increased production efficiency, trade procedures streamline, intra-regional trade agreements, to higher valued-added products propelled by innovation, we are expecting to witness more tight essential strategic partnerships that diversify export categories and destinations.

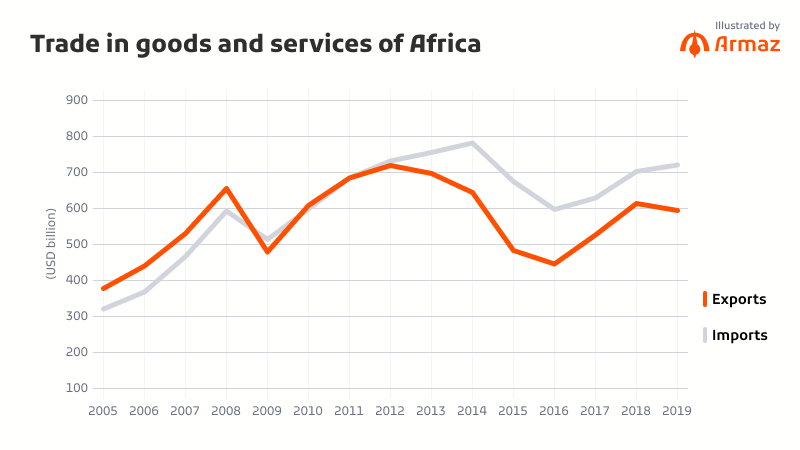

Undeniably, we have experienced an uprising of economic activities in Africa over the past few decades, and the trend will go up along with the youth boom. The value of export goods and services rose 2 times over 15 years from 2005 to 2019. With boosted productivity, the export trade volume of Africa is projected to hit the USD 1 trillion mark by 2035.

African countries have been recovering from COVID-19, and their export activities are rebounding and remaining resilient, with average growth of the overall economy stabilized at around 4 percent annual growth in 2023. The pandemic caused a new world order in which we are starting to see the landscape of African manufacturing led-growth and the integration in the Regional Value Chain. The emergence of more diversified products indicate the potential of export values of Africa in the upcoming years and decades.

Top list

Top product exports, by country in Africa:

Top 1

Top 2

Top 3

🇩🇿 Algeria

40.40%

Petroleum gas

30.20%

Crude petroleum

17.60%

Refined petroleum

🇦🇴 Angola

79.20%

Crude petroleum

9.21%

Petroleum gas

7.92%

Diamonds

🇧🇯 Benin

38.90%

Gold

28.70%

Raw cotton

12.60%

Coconuts, brazil nuts, and cashews

🇧🇼 Botswana

89.60%

Diamonds

1.49%

Insulated wire

1.37%

Copper ore

🇧🇫 Burkina Faso

85.30%

Gold

5.21%

Raw cotton

3.47%

Zinc ore

🇧🇮 Burundi

29.2%

Gold

21.50%

Coffee

14.80%

Tea

🇨🇲 Cameroon

37.90%

Crude petroleum

16.20%

Petroleum gas

11.40%

Cocoa beans

🇨🇻 Cape Verde

42.70%

Processed fish

13.00%

Planes, helicopters, and/or spacecraft

7.98%

Documents of title (bonds etc) and used stamps

🇨🇫 Central African Republic

39.00%

Gold

31.10%

Rough wood

13.40%

Diamonds

🇹🇩 Chad

66.10%

Crude petroleum

27.70%

Gold

4.54%

Other oily seeds

🇰🇲 Comoros

31.00%

Cloves

20.30%

Tug boats

16.90%

Essential oils

🇨🇮 Côte d'Ivoire

30.60%

Cocoa beans

13.90%

Rubber

11.50%

Gold

🇩🇯 Djibouti

51.30%

Palm oil

16.10%

Chlorides

5.08%

Sheep and goats

🇨🇩 Democratic Republic of the Congo

53.60%

Refined copper

26.60%

Cobalt

4.66%

Raw copper

🇪🇬 Egpyt

10.70%

Refined petroleum

8.28%

Crude petroleum

7.85%

Petroleum gas

🇬🇶 Equatorial Guinea

61.70%

Crude petroleum

28.10%

Petroleum gas

7.51%

Acyclic alchols

🇪🇷 Eritrea

39.90%

Zinc ore

31.30%

Copper ore

27.00%

Gold

🇸🇿 Eswatini

24.60%

Scented mixtures

17.00%

Raw sugar

11.20%

Gold

🇪🇹 Ethiopia

26.40%

Coffee

19.50%

Gold

7.65%

Other oily seed

🇬🇦 Gabon

60.70%

Crude petroleum

22.60%

Manganese ore

4.89%

Sawn wood

🇬🇲 Gambia

20.30%

Coconuts, brazil nuts, and cashews

10.60%

Sawn wood

9.87%

Rough wood

🇬🇭 Ghana

37.50%

Gold

25.40%

Crude petroleum

10.70%

Cocoa beans

🇬🇳 Guinea

61.00%

Gold

33.70%

Aluminium ore

0.97%

Aluminium oxide

🇬🇼 Guinea-Bissau

82.10%

Coconuts, brazil nuts, and cashews

11.20%

Petroleum gas

3.23%

Non-fillet frozen fish

🇰🇪 Kenya

16.70%

Tea

10.70%

Cut flowers

3.67%

Coffee

🇱🇸 Lesotho

35.00%

Diamonds

12.00%

Knit women's suits

10.50%

Non-knit men's suits

🇱🇷 Liberia

27.10%

Gold

23.20%

Passenger and cargo ships

23.10%

Iron ore

🇱🇾 Libya

87.60%

Crude petroleum

6.28%

Petroleum gas

1.92%

Refined petroleum

🇲🇬 Madagascar

19.20%

Vanilla

15.30%

Raw nickel

4.53%

Titanium ore

🇲🇼 Malawi

46.10%

Raw tobacco

9.53%

Gold

7.28%

Soybeans

🇲🇱 Mali

96.30%

Gold

0.99%

Raw cotton

0.58%

Other oily seeds

🇲🇷 Mauritania

48.70%

Iron ore

14.60%

Gold

8.43%

Processed crustaceans

🇲🇺 Mauritius

10.70%

Processed fish

8.37%

Raw sugar

4.85%

Non-knit men's suits

🇲🇦 Morocco

12.40%

Cars

12.40%

Mixed mineral or chemical fertilizers

8.54%

Insulated wire

🇲🇿 Mozambique

21.70%

Coal briquettes

17.30%

Raw aluminium

5.58%

Gold

Trade made easy with Armaz Capital ➔

🇳🇦 Namibia

19.50%

Diamonds

12.70%

Radioactive chemicals

11.30%

Raw copper

🇳🇪 Niger

71.40%

Gold

9.11%

Other oily seeds

7.84%

Radioactive chemicals

🇳🇬 Nigeria

72.50%

Crude petroleum

14.80%

Petroleum gas

2.16%

Special purpose ships

🇨🇬 Republic of the Congo

47.20%

Refined copper

25.40%

Crude petroleum

4.72%

Refined petroleum

🇷🇼 Rwanda

23.20%

Gold

6.73%

Refined petroleum

6.25%

Tin ores

🇸🇹 São Tomé and Príncipe

43.20%

Cocoa beans

17.20%

Palm oil

15.30%

Gas turbines

🇸🇳 Senegal

19.20%

Gold

11.80%

Refined petroleum

9.02%

Phosphoric acid

🇸🇨 Seychelles

64.20%

Recreational boats

12.70%

Non-fillet frozen fish

11.50%

Processed fish

🇸🇱 Sierra Leone

24.20%

Titanium ore

18.60%

Iron ore

14.80%

Rough wood

🇸🇴 Somalia

41.70%

Sheep and goats

19.70%

Gold

7.26%

Bovine

🇿🇦 South Africa

17.40%

Platinum

14.00%

Gold

5.35%

Iron ore

🇸🇸 South Sudan

80.80%

Crude peroleum

15.10%

Refined petroleum

1.73%

Forage crops

🇸🇩 Sudan

52.30%

Gold

8.97%

Ground nuts

7.65%

Other oily seeds

🇹🇿 Tanzania

36.70%

Gold

9.53%

Raw copper

3.75%

Dried legumes

🇹🇬 Togo

29.00%

Refined petroleum

17.80%

Gold

7.65%

Asphalt mixtures

🇹🇳 Tunisia

14.00%

Insulated wire

4.00%

Crude peroleum

3.91%

Non-knit men's suits

🇺🇬 Uganda

55.90%

Gold

15.40%

Coffee

2.06%

Cocoa beans

🇿🇲 Zambia

47.30%

Raw copper

22.20%

Refined copper

6.08%

Gold

🇿🇼 Zimbabwe

46.80%

Gold

16.60%

Nickel matters

11.50%

Raw tobacco

Animal and vegetable bi-products

Animal products

Chemical products

Foodstuffs

Machines

Metals

Mineral products

Paper goods

Plastics and rubbers

Precious metals

Textiles

Transportation

Vegetable products

Wood products

World's biggest exporters, from Africa:

World's top exporter

Top destination

Aluminium ore

🇬🇳 Guinea

China

Calcium phosphates

🇲🇦 Morocco

India

Chromium ore

🇿🇦 South Africa

China

Cloves

🇲🇬 Madagascar

India

Cobalt

🇨🇩 DR Congo

China

Cobalt ore

🇨🇩 DR Congo

China

Cocoa beans

🇨🇮 Côte d'Ivoire

Netherlands

Cocoa paste

🇨🇮 Côte d'Ivoire

Netherlands

Cocoa shells

🇳🇬 Nigeria

Netherlands

Copper alloys

🇨🇩 DR Congo

China

Densified wood

🇦🇴 Angola

Vietnam

Glazed ceramics

🇪🇬 Egypt

Libya

Ground nut meal

🇸🇩 Sudan

China

Legumes

🇲🇦 Morocco

Spain

Manganese ore

🇿🇦 South Africa

China

Start Africa trade with Armaz Capital ➔

Phosphoric acid

🇲🇦 Morocco

India

Platinum

🇿🇦 South Africa

United States

Precious metal ore

🇿🇦 South Africa

Germany

Raw copper

🇿🇲 Zambia

Switzerland

Tin ores

🇨🇩 DR Congo

China

Titanium ore

🇿🇦 South Africa

Netherlands

Tungsten ore

🇷🇼 Rwanda

Singapore

Vanilla

🇲🇬 Madagascar

United States

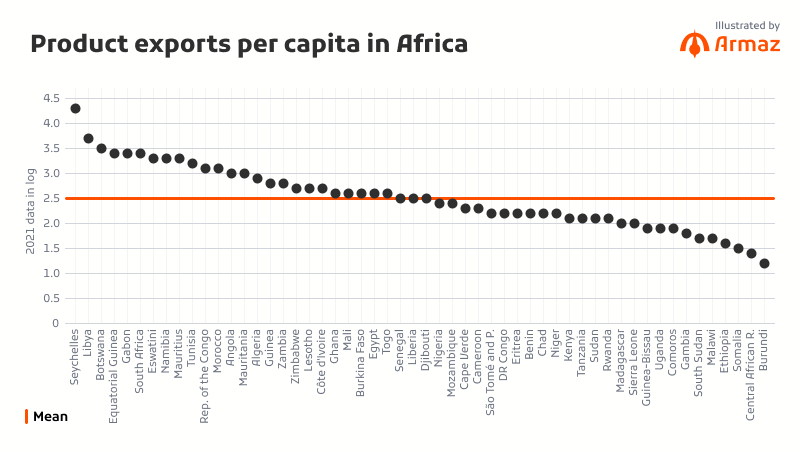

Product exports per capita, by country in Africa:

1

2

3

4

🇸🇨 Seychelles

🇱🇾 Libya

🇧🇼 Botswana

🇬🇶 Equatorial Guinea

$22,100

$4,570

$2,960

$2,760

5

6

7

8

🇬🇦 Gabon

🇿🇦 South Africa

🇸🇿 Eswatini

🇳🇦 Namibia

$2,540

$2,420

$2,100

$1,870

9

10

11

...

🇲🇺 Mauritius

🇹🇳 Tunisia

🇨🇩 Democratic Republic of the Congo

...

$1,780

$1,530

$1,160

...

Top product export destinations, by country in Africa:

Top 1

Top 2

Top 3

🇩🇿 Algeria

20.70%

Italy

14.30%

Spain

13.00%

France

🇦🇴 Angola

58.30%

China

8.28%

India

5.29%

United Arab Emirates

🇧🇯 Benin

39.20%

United Arab Emirates

19.60%

Bangladesh

15.70%

India

🇧🇼 Botswana

United Arab Emirates

21.70%

Belgium

17.00%

India

🇧🇫 Burkina Faso

76.80%

Switzerland

10.70%

India

2.16%

Singapore

🇧🇮 Burundi

31.80%

United Arab Emirates

13.90%

Democratic Republic of the Congo

6.66%

Germany

🇨🇲 Cameroon

28.90%

China

13.60%

Netherlands

8.55%

India

🇨🇻 Cape Verde

63.00%

Spain

8.00%

Angola

7.96%

Portugal

🇨🇫 Central African Republic

34.20%

United Arab Emirates

26.00%

China

14.10%

Italy

🇹🇩 Chad

34.30%

Germany

28.10%

United Arab Emirates

14.80%

Chinese Taipei

🇰🇲 Comoros

21.00%

India

20.80%

Greece

13.40%

France

🇨🇮 Côte d'Ivoire

9.73%

Netherlands

9.62%

United States

7.65%

Vietnam

🇩🇯 Djibouti

53.00%

Ethiopia

15.90%

China

10.50%

India

🇨🇩 Democratic Republic of the Congo

67.80%

China

6.73%

United Arab Emirates

4.92%

South Korea

🇪🇬 Egpyt

8.32%

United States

6.94%

Turkey

6.67%

Greece

🇬🇶 Equatorial Guinea

23.40%

China

16.50%

India

15.70%

Spain

🇪🇷 Eritrea

56.80%

China

27.20%

United Arab Emirates

14.50%

South Korea

🇸🇿 Eswatini

56.00%

South Africa

11.40%

India

5.33%

Kenya

🇪🇹 Ethiopia

23.80%

United Arab Emirates

11.20%

United States

8.18%

Somalia

🇬🇦 Gabon

37.60%

China

14.70%

India

8.75%

South Korea

🇬🇲 Gambia

30.90%

China

27.00%

India

7.73%

Mali

🇬🇭 Ghana

17.40%

Switzerland

12.30%

United Arab Emirates

11.10%

United States

🇬🇳 Guinea

35.90%

India

26.80%

United Arab Emirates

24.90%

China

🇬🇼 Guinea-Bissau

81.30%

India

11.20%

Pakistan

2.52%

Turkey

🇰🇪 Kenya

11.60%

Uganda

8.06%

Netherlands

7.92%

United States

🇱🇸 Lesotho

32.20%

United States

30.40%

South Africa

23.60%

Belgium

🇱🇷 Liberia

21.60%

Switzerland

12.80%

Poland

10.00%

France

🇱🇾 Libya

24.20%

Italty

10.60%

Germany

9.90%

Spain

🇲🇬 Madagascar

18.70%

United States

17.50%

France

11.70%

China

🇲🇼 Malawi

11.10%

Germany

10.10%

United Arab Emirates

9.44%

India

🇲🇱 Mali

78.10%

United Arab Emirates

14.50%

Switzerland

3.55%

Australia

🇲🇷 Mauritania

42.50%

China

9.39%

Spain

8.13%

Canada

🇲🇺 Mauritius

10.60%

France

10.50%

South Africa

8.75%

Zimbabwe

🇲🇦 Morocco

20.30%

Spain

18.80%

France

5.02%

India

🇲🇿 Mozambique

16.70%

India

11.40%

South Africa

10.90%

China

Professional FDI advisory by Armaz Capital ➔

🇳🇦 Namibia

20.90%

South Africa

15.00%

China

12.00%

Belgium

🇳🇪 Niger

70.80%

United Arab Emirates

9.10%

China

5.21%

France

🇳🇬 Nigeria

15.70%

India

11.60%

Spain

6.40%

United States

🇨🇬 Republic of the Congo

26.00%

United Arab Emirates

16.60%

China

7.87%

Greece

🇷🇼 Rwanda

37.00%

Democratic Republic of the Congo

27.60%

United Arab Emirates

4.96%

Thailand

🇸🇹 São Tomé and Príncipe

22.50%

Netherlands

13.40%

Singapore

10.40%

Belgium

🇸🇳 Senegal

22.00%

Mali

14.50%

Switzerland

10.10%

India

🇸🇨 Seychelles

29.40%

Gibraltar

13.70%

Cayman Islands

10.70%

Bermuda

🇸🇱 Sierra Leone

39.00%

China

18.40%

Belgium

8.02%

Germany

🇸🇴 Somalia

37.40%

Oman

28.60%

United Arab Emirates

9.8%

Saudi Arabia

🇿🇦 South Africa

14.40%

China

9.72%

United States

7.22%

Germany

🇸🇸 South Sudan

53.10%

China

15.70%

Italy

15.20%

Singapore

🇸🇩 Sudan

53.30%

United Arab Emirates

14.30%

China

6.27%

Saudi Arabia

🇹🇿 Tanzania

21.70%

India

15.60%

United Arab Emirates

10.80%

South Africa

🇹🇬 Togo

17.90%

United Arab Emirates

16.60%

Angola

10.10%

China

🇹🇳 Tunisia

24.80%

France

17.20%

Italy

13.80%

Germany

🇺🇬 Uganda

56.20%

United Arab Emirates

8.23%

Kenya

5.57%

Italy

🇿🇲 Zambia

35.10%

Switzerland

16.90%

China

10.70%

Singapore

🇿🇼 Zimbabwe

49.20%

United Arab Emirates

25.10%

South Africa

7.15%

China

Africa

Asia

Europe

North America

Oceania

Africa's product and service exports valued USD 1.41 billion in 2021, in which an average of 15 percent of total African exports was estimated to be intra-trade. Leveraging its natural resources, the export value of mineral commodities and precious metals such as gold, diamonds, and petroleum products are significant, compared to other continents.

Service exports from Africa are rather on the low side. In 2021, the continent's service exports accounted for 15.6% of the total African exports of both goods and services, compared to pre-pandemic with 20.8% in 2019. (Armaz Capital is specialized in exports of goods, so the coverage of services is reduced in this writing.)

Opportunities

Based on the expansive population pyramid, investors could quickly realize investing in Africa offers early access to the fastest growing continent with immense potential. By tapping into Africa's export industry, investors can position themselves to capitalize the rising demand for goods and services both domestically and internationally.

Expanding consumer markets:

We will witness the societal shifts of the upcoming generations of youth, with an average of under 19 years old, whose potential is yet to be unleashed with new job creation. More people are undergoing urbanization, and entering the emerging middle class with higher purchasing power and demands for fast-moving consumer goods, electronics, and other products.

Supportive policy environment:

African governments have been actively unlocking partnerships with trading organizations both in the continent and beyond. Initiatives like the African Continental Free Trade Area (AfCFTA) attempts to harmonize trade regulations and facilitate cross-border trade of goods. The COMESA-EAC-SADC tripartite free trade area is also accelerating economic integration across African countries. China's One Belt One Road has activated more ports opened in Africa. Reduction of trade barriers also means more raw and processed goods could be moved freely across the continent with streamlined customs producers, which benefits supply chain operators, investors and business owners.

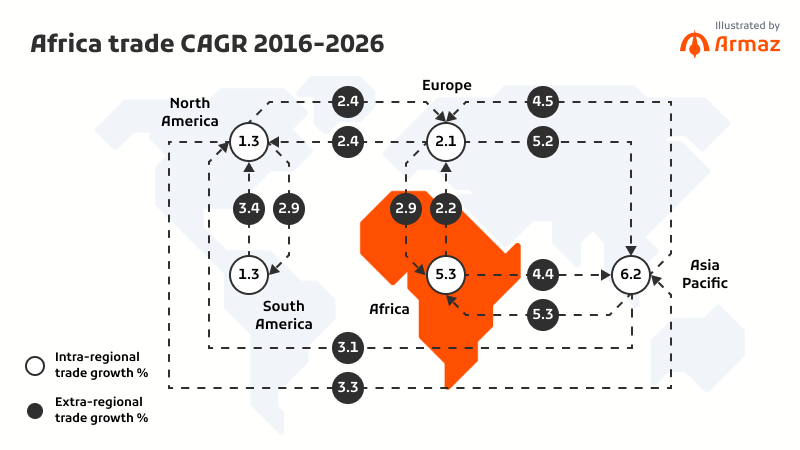

Export to the East:

The vitality of export trade is seen more actively with Eastern countries than the countries in Europe and North Africa. China has injected human capital and industrial facilities for large-scale engineering instructure, which in return has proven to strengthen mutual trade activities. The world's highest population country, India also enjoyed rich import resources from Africa. The United Arab Emirate has gained global attention during COVID-19 thanks to the inflow of wealthy individuals who were convinced by the forward-thinking digital industry policy. The rise of the UAE economy has greatly increased the mobility of various export products from Africa, beyond diamonds, and petroleum byproducts.

Abundant resources:

Due to the abundant arable land, African countries have been investing in agricultural developments, from higher yield farming methods, technology-enable production lines, to various end-product presentations for global consumers. Industrialization efforts also boost the output of manufacturing exports and textiles. The advancement of production facilities has enhanced the exported products not only in the raw form, but also in usable components and semi-finished goods.

Higher export diversification:

Besides more complex manufacturing products such as optical and textiles, Africa has been adding new products to its export baskets. Items such as base metals, footwear, fats and oils, have seen rosen in the past few years. As mentioned, AfCFTA is one key catalyst. The access to cross-country services and intermediate inputs within Africa, attracted foreign investments which were then injected to ignite the export volume of value-added goods to meet external demands.

Despite the optimistic findings, Africa is allocating resources to address complex hurdles such as infrastructural deficiencies, and market volatility. Besides governmental intervention to make the market more free for international trade, the continent required foreign investments to fully harness its export potential.

Sources: WTO, UNCTAD, WITS, ICDT, IFC, ITC, IMF, Word Bank, WEF, OEC, BACI (2021), and many more governments' and NGO materials, etc.

Looking to import & export in Africa?

Meet our specialists to explore allocating investments or starting large-volume good trade in Africa.

Schedule a callHeadquarters: N'Djamena 🇹🇩

HQ address: Boulevard Du President N'Garta Tombalbaye BP:7469 N'Djamena, Chad

+235 64783674