Africa's Top Product Imports and Origins

February 2024

Research

Trade

Overview

Africa, often referred to as the next frontier of global trade, has shown tremendous growth in economic activities since the beginning of this century. It is a continent teeming with promise and ripe for import-related investment, with more foreign investors tapping into boundless trade business opportunities. Africa's economic landscape is undergoing a remarkable transformation, from a rapidly expanding consumer base fueled by a burgeoning middle class in the process of urbanization, to a youthful demographic dividend that is more educated to leverage modern technology knowledge with global and avant-garde mindsets.

Historical challenges of Africa are relieving thanks to years of international humanitarian funding and external resources for basic urban development. A wide array of economic sectors are starting to emerge, from construction to agribusiness, renewable energy, and beyond, with more and more locals entering the entrepreneurship game. The result is not simply about measuring the number of new jobs created, but instead illuminating a more diverse and vibrant society where everyday people could enjoy quality food commodities, access to medical services, and increased mobility across countries for travel and logistics.

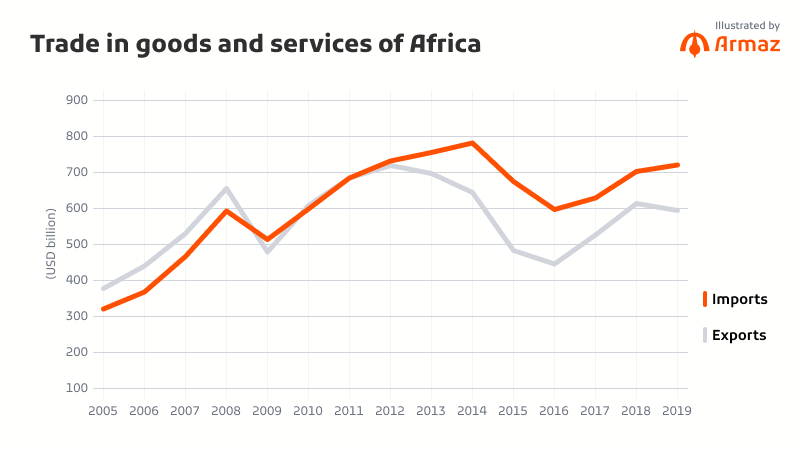

Many unparalleled opportunities are still yet to be discovered by foreigners who have experiences and knowledge in product trade previously outside of Africa. The continuous increased import trade volume in Africa, reflecting the continent's evolving economic landscape and consumer preferences. Infrastructure development and Internet facilities have created a new wave of consumer purchases in electronics, consumer packaged goods, and textile products. Governments are also seizing ample chances to upgrade their transportation and healthcare systems with imported materials. Clear enough, Africa offers a myriad of prospects for foreign import businesses seeking to establish a foothold on this fertile ground to capitalize on the vast potential that this dynamic continent has to offer.

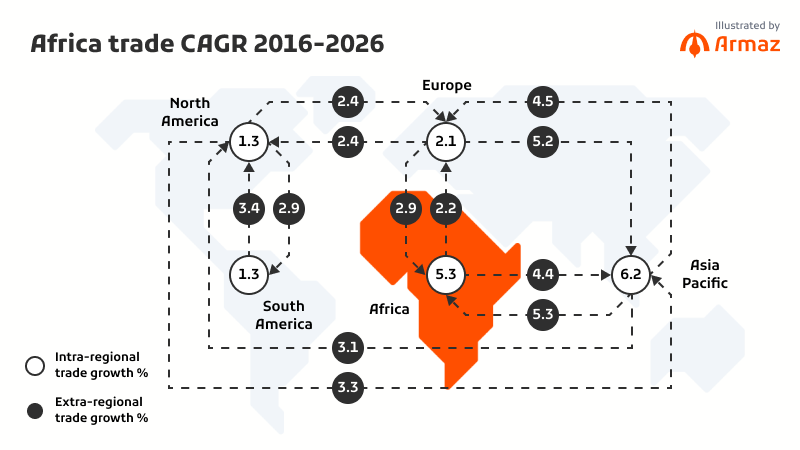

Growth

The population growth outpaced the foundational development progress of Africa. There have been joint forces from external philanthropic and impact-first capital focused on interventions at the farmer level to increase productivity of agriculture. Many supply chain facilities are still yet to be established to ship the upstream produce to consumers' hands. To cater the growing demand, African countries plugged the gaps through importing around 85% food commodities from outside the continent.

Driven by economic growth, urbanization, and demographic shifts, some new categories of consumer products are attracting foreign importers. Consumer electronics under the emerging tech-driven lifestyle, automotive cars because of more paved roads, higher purchasing power of FMCGs and apparel due to the increase of disposable income, these all signify the trend of younger population's demand on items that are not produced domestically. Africa's consumer expenditure is projected to reach USD 2.5 trillion by 2030.

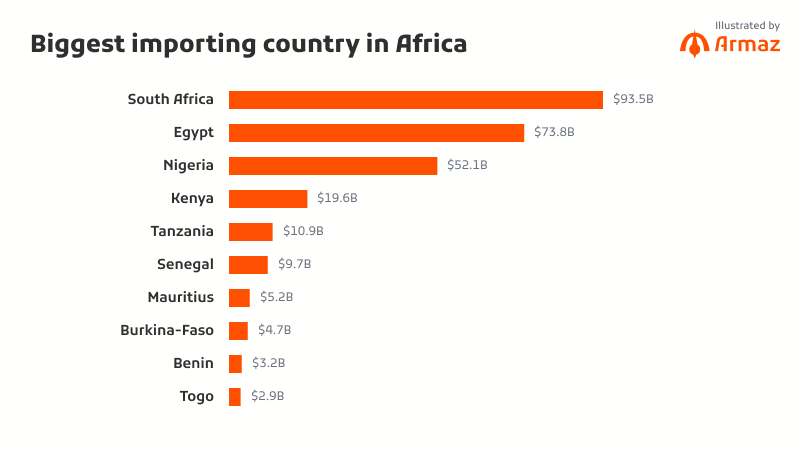

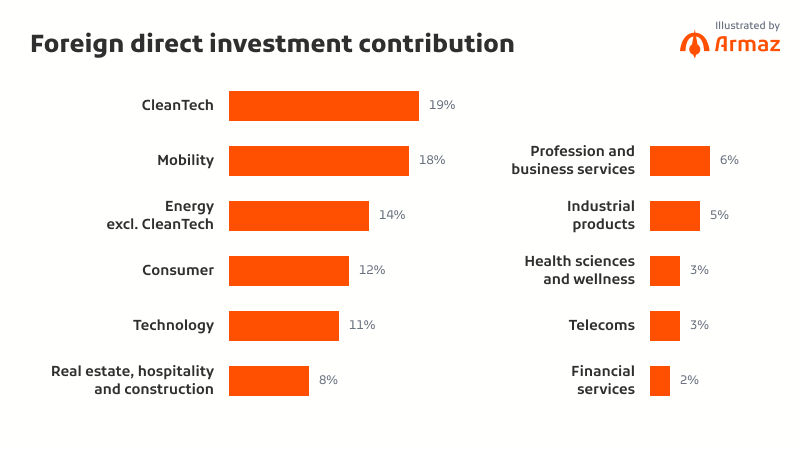

The dynamic nature of Africa's consumer market made more foreign import players realize the lucrative opportunities. The “big four” markets of Africa - South Africa, Egypt, Nigeria, and Kenya, are the biggest importer countries among the skyrocketing USD 35 billion import volume in 2021 in Africa. Importers' associated businesses started to operate beyond importing finished goods from the origins, instead setting up local facilities to handle intermediate products. The initial thoughts of transportation cost reduction has also led to new job opportunities, environmental sustainability promotion, and more importantly higher foreign direct investment amounts that encourage governments to propose new policies to further strengthen local economies and more efficient transportation facilities.

Among all the sectors, automotive, agro-processing, pharmaceuticals, and logistics have gained massive interest from external importers. Following the trade data, these sectors are also on the upward trend, accelerating urbanization with more goods and services that make mobility more accessible, make everyday life healthier.

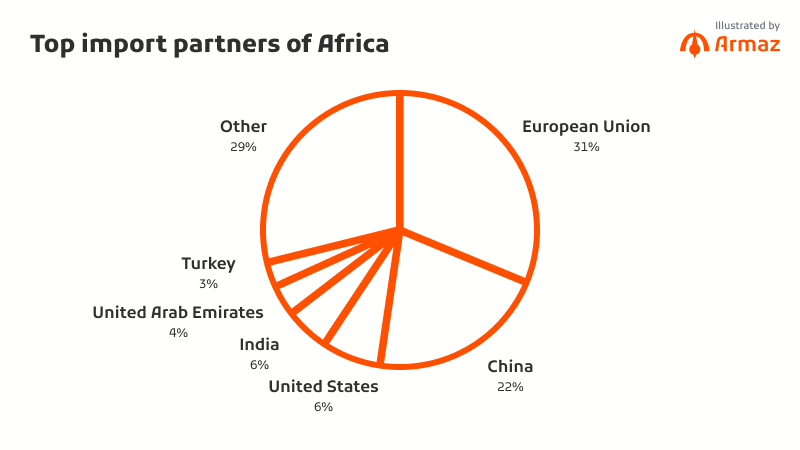

The trade relationship of Africa has shifted from the European Union countries like France to China since 2000, with 20% of its economic growth being contributed from this new alliance. Africa mostly exports natural resources, and imports consumer and intermediate goods, with reasons briefly covered above.

Top list

Top product imports, by country in Africa:

Top 1

Top 2

Top 3

🇩🇿 Algeria

6.43%

Wheat

3.71%

Concentrated milk

2.33%

Soybean oil

🇦🇴 Angola

11.70%

Refined petroleum

3.42%

Wheat

2.15%

Poultry meat

🇧🇯 Benin

14.00%

Rice

6.97%

Cars

5.97%

Palm oil

🇧🇼 Botswana

33.70%

Diamonds

9.86%

Refined petroleum

1.88%

Delivery trucks

🇧🇫 Burkina Faso

12.80%

Refined petroleum

3.68%

Packaged medicaments

2.18%

Cement

🇧🇮 Burundi

15.70%

Refined petroleum

4.24%

Packaged medicaments

3.64%

Cement

🇨🇲 Cameroon

6.22%

Special purpose ships

4.79%

Refined petroleum

4.19%

Other furniture

🇨🇻 Cape Verde

13.50%

Delivery trucks

10.80%

Refined petroleum

2.23%

Cars

🇨🇫 Central African Republic

7.14%

Packaged medicaments

6.91%

Broadcasting equipment

4.48%

Vaccines, blood, antisera, tokxins and cultures

🇹🇩 Chad

7.19%

Non-knit women's suits

5.98%

Cars

4.77%

Jewellery

🇰🇲 Comoros

13.90%

Refined petroleum

10.60%

Vaccines, blood, antisera, tokxins and cultures

6.46%

Rice

🇨🇮 Côte d'Ivoire

10.40%

Crude petroleum

5.48%

Rice

3.95%

Non-fillet frozen fish

🇩🇯 Djibouti

24.60%

Refined petroleum

5.19%

Palm oil

3.17%

Mixed mineral or chemical fertilizers

🇨🇩 Democratic Republic of the Congo

4.34%

Refined petroleum

2.72%

Packaged medicaments

2.29%

Poultry meat

🇪🇬 Egpyt

5.74%

Refined petroleum

4.63%

Wheat

4.06%

Cars

🇬🇶 Equatorial Guinea

12.80%

Special purpose ships

4.58%

Poultry meat

3.85%

Beer

🇪🇷 Eritrea

4.55%

Other edible preparations

4.30%

Wheat

4.17%

Sorghum

🇸🇿 Eswatini

8.32%

Refined petroleum

6.62%

Electricity

2.61%

Medical instruments

🇪🇹 Ethiopia

7.85%

Wheat

6.63%

Refined petroleum

4.45%

Gas turbines

🇬🇦 Gabon

4.43%

Poultry meat

2.78%

Packaged medicaments

2.71%

Passenger and cargo ships

🇬🇲 Gambia

9.75%

Light pure woven cotton

5.79%

Refined petroleum

4.11%

Palm oil

🇬🇭 Ghana

4.95%

Refined Petroleum

3.11%

Cars

2.73%

Rice

🇬🇳 Guinea

6.32%

Rice

2.74%

Motorcycles and cycles

2.66%

Cars

🇬🇼 Guinea-Bissau

12.70%

Refined petroleum

8.40%

Rice

7.81%

Fishing ships

🇰🇪 Kenya

15.30%

Refined petroleum

5.48%

Palm oil

2.41%

Packaged medicaments

🇱🇸 Lesotho

10.50%

Refined petroleum

5.02%

Light rubberized knitted fabric

2.45%

Poultry meat

🇱🇷 Liberia

61.40%

Passenger and cargo ships

19.80%

Refined petroleum

1.87%

Machines for additive manufacturing

🇱🇾 Libya

20.00%

Refined petroleum

3.48%

Rolled tobacco

3.23%

Broadcasting equipments

🇲🇬 Madagascar

9.63%

Refined petroleum

5.19%

Rice

3.40%

Palm oil

🇲🇼 Malawi

5.16%

Packaged medicaments

4.57%

Broadcasting equipments

2.83%

Vaccines, blood, antisera, toxins and cultures

🇲🇱 Mali

14.60%

Refined petroleum

5.21%

Broadcasting equipments

5.16%

Light pure woven cotton

🇲🇷 Mauritania

8.52%

Gold

3.64%

Wheat

3.61%

Cars

🇲🇺 Mauritius

12.70%

Refined petroleum

4.04%

Non-fillet frozen fish

3.35%

Cars

🇲🇦 Morocco

8.82%

Refined petroleum

3.73%

Cars

3.38

Motor vehicles; parts and accessories (8701 to 8705)

🇲🇿 Mozambique

15.40%

Special purpose ships

11.70%

Refined petroleum

5.50%

Iron ore

Trade made easy with Armaz Capital ➔

🇳🇦 Namibia

13.80%

Special purpose ships

5.26%

Copper ore

3.99%

Electricity

🇳🇪 Niger

11.80%

Rice

4.83%

Cars

2.97%

Rolled tobacco

🇳🇬 Nigeria

18.30%

Refined petroleum

5.38%

Wheat

3.93%

Cars

🇨🇬 Republic of the Congo

4.66%

Poultry meat

4.51%

Special purpose ships

3.43%

Refined petroleum

🇷🇼 Rwanda

8.44%

Refined petroleum

8.04%

Gold

3.58%

Palm oil

🇸🇹 São Tomé and Príncipe

4.33%

Rice

3.64%

Cars

3.07%

Wine

🇸🇳 Senegal

16.70%

Refined petroleum

3.32%

Rice

3.23%

Crude petroleum

🇸🇨 Seychelles

33.50%

Recreational boats

10.60%

Refined petroleum

5.66%

Other vegetable residues

🇸🇱 Sierra Leone

8.13%

Rice

4.42%

Refined petroleum

4.02%

Cars

🇸🇴 Somalia

9.48%

Rolled tobacco

6.80%

Raw sugar

5.03%

Other vegetables

🇿🇦 South Africa

8.12%

Refined petroleum

5.60%

Crude petroleum

3.55%

Motor vehicles; parts and accessories (8701 to 8705)

🇸🇸 South Sudan

7.01%

Delivery trucks

5.77%

Cars

4.52%

Other edible preparations

🇸🇩 Sudan

10.00%

Raw sugar

6.76%

Refined petroleum

5.92%

Wheat

🇹🇿 Tanzania

16.00%

Refined petroleum

3.20%

Palm oil

2.40%

Packaged medicaments

🇹🇬 Togo

42.50%

Refined petroleum

5.15%

Motorcycles and cycles

3.15%

Crude petroleum

🇹🇳 Tunisia

8.28%

Refined petroleum

4.01%

Petroleum gas

2.79%

Cars

🇺🇬 Uganda

5.42%

Vaccines, blood, antisera, toxins and cultures

5.02%

Packaged medicaments

3.18%

Delivery trucks

🇿🇲 Zambia

8.46%

Refined petroleum

3.91%

Nitrogenous fertilizers

2.80%

Delivery trucks

🇿🇼 Zimbabwe

14.60%

Refined petroleum

3.53%

Vaccines, blood, antisera, toxins and cultures

2.78%

Delivery trucks

Animal and vegetable bi-products

Animal products

Chemical products

Foodstuffs

Machines

Metals

Mineral products

Paper goods

Plastics and rubbers

Precious metals

Textiles

Transportation

Vegetable products

Wood products

World's biggest importers, from Africa:

Top origin

World's top importer

Documents of title (bonds etc) and unused stamps

Switzerland

🇿🇦 South Africa

Equine and bovine hides

Tanzania

🇳🇬 Nigeria

Eyewear and clock glass

China

🇦🇴 Angola

Flourides

Singapore

🇲🇿 Mozambique

Metallic fabric

China

🇿🇦 South Africa

Start Africa trade with Armaz Capital ➔

Passenger and cargo ships

China

🇱🇷 Liberia

Processed synthetic staple fibers

Japan

🇸🇳 Senegal

Railway passenger cars

Russia

🇪🇬 Egypt

Special purpose ships

South Korea

🇲🇿 Mozambique

Synthetic filament tow

Japan

🇳🇬 Nigeria

Used clothing

United Kingdom

🇬🇭 Ghana

Wheat

Russia

🇪🇬 Egypt

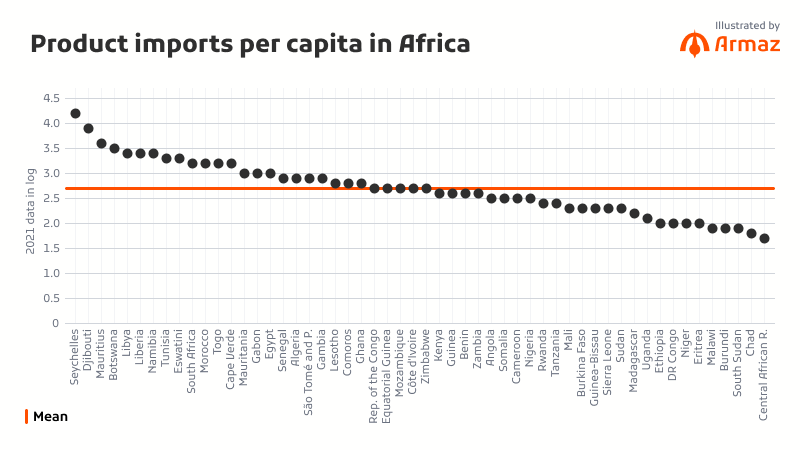

Product imports per capita, by country in Africa:

1

2

3

4

🇸🇨 Seychelles

🇩🇯 Djibouti

🇲🇺 Mauritius

🇧🇼 Botswana

$16,300

$7,480

$4,360

$3,090

5

6

7

8

🇱🇾 Libya

🇱🇷 Liberia

🇳🇦 Namibia

🇹🇳 Tunisia

$2,720

$2,550

$2,360

$1,910

9

10

11

...

🇸🇿 Eswatini

🇿🇦 South Africa

🇲🇦 Morocco

...

$1,820

$1,630

$1,540

...

Top product import origins, by country in Africa:

Top 1

Top 2

Top 3

🇩🇿 Algeria

18.50%

China

12.70%

France

6.40%

Spain

🇦🇴 Angola

20.40%

China

10.60%

Portugal

5.07%

Togo

🇧🇯 Benin

21.50%

China

12.20%

India

5.83%

France

🇧🇼 Botswana

55.90%

South Africa

12.40%

Belgium

5.32%

United Arab Emirates

🇧🇫 Burkina Faso

12.90%

China

8.49%

Côte d'Ivoire

7.86%

France

🇧🇮 Burundi

18.00%

China

11.60%

Saudi Arabia

10.80%

Tanzania

🇨🇲 Cameroon

34.10%

China

7.80%

France

6.91%

Nigeria

🇨🇻 Cape Verde

40.80%

Portugal

13.10%

South Africa

9.71%

China

🇨🇫 Central African Republic

16.40%

China

14.40%

France

7.61%

India

🇹🇩 Chad

33.60%

China

23.80%

United Arab Emirates

7.55%

France

🇰🇲 Comoros

34.00%

United Arab Emirates

12.30%

China

9.31%

France

🇨🇮 Côte d'Ivoire

22.30%

China

11.50%

France

9.47%

Nigeria

🇩🇯 Djibouti

31.30%

China

21.80%

Saudi Arabia

12.40%

United Arab Emirates

🇨🇩 Democratic Republic of the Congo

29.40%

China

11.90%

Zambia

11.50%

South Africa

🇪🇬 Egpyt

18.49%

China

9.01%

Saudi Arabia

5.68%

United States

🇬🇶 Equatorial Guinea

22.20%

Spain

14.40%

China

13.50%

Nigeria

🇪🇷 Eritrea

31.90%

United Arab Emirates

21.20%

China

7.19%

Turkey

🇸🇿 Eswatini

70.60%

South Africa

9.72%

China

2.68%

India

🇪🇹 Ethiopia

23.70%

China

9.21%

India

6.76%

United States

🇬🇦 Gabon

22.00%

France

20.30%

China

5.40%

United Arab Emirates

🇬🇲 Gambia

30.10%

China

9.54%

Senegal

8.79%

India

🇬🇭 Ghana

40.00%

China

5.43%

India

5.12%

Netherlands

🇬🇳 Guinea

40.90%

China

11.30%

India

4.59%

United Arab Emirates

🇬🇼 Guinea-Bissau

25.90%

Portugal

21.20%

China

17.80%

Senegal

🇰🇪 Kenya

25.30%

China

11.10%

India

7.88%

United Arab Emirates

🇱🇸 Lesotho

87.20%

South Africa

5.30%

China

2.98%

Chinese Taipei

🇱🇷 Liberia

43.00%

China

18.10%

Japan

15.00%

South Korea

🇱🇾 Libya

15.10%

Turkey

13.00%

Greece

11.60%

China

🇲🇬 Madagascar

27.70%

China

8.90%

France

7.75%

India

🇲🇼 Malawi

28.40%

South Africa

17.00%

China

9.42%

India

🇲🇱 Mali

23.00%

Senegal

13.00%

China

10.10%

France

🇲🇷 Mauritania

20.10%

China

11.80%

Turkey

7.98%

France

🇲🇺 Mauritius

18.40%

China

14.30%

India

8.58%

South Africa

🇲🇦 Morocco

19.50%

Spain

11.30%

China

9.52%

France

🇲🇿 Mozambique

25.40%

South Africa

15.60%

South Korea

14.40%

China

Professional FDI advisory by Armaz Capital ➔

🇳🇦 Namibia

57.60%

South Africa

11.20%

Nigeria

6.73%

China

🇳🇪 Niger

18.90%

China

8.27%

France

7.95%

United States

🇳🇬 Nigeria

35.50%

China

7.70%

India

7.44%

Netherlands

🇨🇬 Republic of the Congo

20.40%

China

9.28%

France

4.88%

Belgium

🇷🇼 Rwanda

17.20%

China

12.10%

Tanzania

8.50%

United Arab Emirates

🇸🇹 São Tomé and Príncipe

50.10%

Portugal

11.10%

China

3.65%

Belgium

🇸🇳 Senegal

21.20%

China

9.15%

Russia

7.62%

France

🇸🇨 Seychelles

17.90%

Netherlands

16.20%

United Arab Emirates

13.80%

Italy

🇸🇱 Sierra Leone

30.60%

China

12.00%

India

8.43%

Turkey

🇸🇴 Somalia

30.20%

United Arab Emirates

19.70%

China

13.80%

India

🇿🇦 South Africa

21.20%

China

9.20%

Germany

6.21%

India

🇸🇸 South Sudan

38.70%

United Arab Emirates

15.90%

Kenya

16.10%

China

🇸🇩 Sudan

21.20%

China

15.90%

United Arab Emirates

13.60%

Saudi Arabia

🇹🇿 Tanzania

34.30%

China

10.90%

India

10.40%

United Arab Emirates

🇹🇬 Togo

22.90%

China

22.30%

India

8.68%

Netherlands

🇹🇳 Tunisia

14.90%

France

13.20%

Italy

9.39%

China

🇺🇬 Uganda

19.80%

China

16.10%

Kenya

13.40%

India

🇿🇲 Zambia

32.80%

South Africa

13.40%

China

11.70%

United Arab Emirates

🇿🇼 Zimbabwe

40.60%

South Africa

13.40%

China

13.00%

Singapore

Africa

Asia

Europe

North America

Oceania

Opportunities

Based on the expansive population pyramid, investors could quickly realize investing in Africa offers early access to the fastest growing continent with immense potential. By tapping into Africa's import industry, investors can position themselves to capitalize the rising demand for goods and services both domestically and internationally.

Increase of purchasing power:

The expanding consumer market is obvious with more youth entering the middle class, who prefer to pursue more sophisticated and demanding higher-quality imported brands and goods. A wide array of consumers are on the rise as more African people are seeking convenience and variety of products through both offline and online shipping of packaged foods and beverages, household items, and personal care products.

Made in Africa:

The import demand has been decreasing for raw materials over the last 10 years, due to the abundant natural resources. Instead, the import volume of capital goods, consumer goods, and intermediate goods are climbing. More industrialization efforts are being implemented domestically to enhance the supply chain with more advanced production facilities, along with the adoption of sophisticated digital trade systems. Imported goods are also transformed into more value-added intermediates and end products, which are being traded to serve sectors like automotives and transportation, as well as to meet the consumer needs in areas such as foodstuffs and apparel products.

Collaborative trade initiatives:

Initiatives like the African Continental Free Trade Area (AfCFTA) attempts to harmonize trade regulations and facilitate cross-border trade of goods. The COMESA-EAC-SADC tripartite free trade area is also accelerating economic integration across African countries. More trans-Africa transport corridors and ports are activated to boost trade. With more governments offering friendlier custom tariff strategies, more raw and processed goods could be imported and moved freely across the continent which benefits supply chain operators, investors, business owners, and governments themselves.

Construction and engineering projects:

Urbanization has a proven solution to increase living standards, employment opportunities, as well as positive externalities and economies of scale. Africa has undergone massive infrastructure development which attracted not only human capital and knowledge, but also importing machinery and electrical equipment, chemical products, and transportation facilities to smoothen the transaction of import items for the big-scale engineering projects.

Renewables on the rise:

The success of the energy transition in South Africa and Egypt, has motivated more countries to open up fast track policies to partner with external resource providers and skilled workers to explore renewable alternatives. The abundance of natural sunlight and wind have attracted the development of solar energy and wind power engineering projects, with foreign investments, human capital, and imported materials; other approaches like hydro, bioenergy, and even geothermal, are gaining interest.

Sector highlight

Intra-regional trade of vegetable and animal products have shown significant growth across Africa countries. China, has rich agricultural productivity outputs particularly in rice and wheat, becoming a favorable importer partner for food sustainability. Textile and electronic products are also under the umbrella of the import list from this manufacturing giant.

China is not the only country that contributes to Africa's economies. Besides the United States and EU who have been strong partners, other African countries and India have increased merchandise and industrial imports. Middle East countries such as UAE and Turkey are also on the top list of importers in recent years.

The growing sectors that are worth mentioning are automotive, agriculture and agro-processing, pharmaceuticals, and transport and logistics, which are transforming the economies of Africa in all possible dimensions.

Automotive:

The demand for automobiles has skyrocketed and will keep increasing due to rapid urbanization. Over half of the current automotive supply is from outside the continent, including used commercial vehicles and motor cars. Production is already growing, in places like Morocco and South Africa, in parallel, more foreign leading automotive companies are injecting resources to support domestics operations.

Agriculture and agro-processing:

Productivity levels have been a core issue to tackle as most of the local produce are from smallholder farmers. To meet the growing consumer demand, and to greatly improve value-added agricultural intermediates, import opportunities exist for machinery and technology, irrigation systems, fertilizers and seeds, and other crop protection and security facilities.

Pharmaceuticals:

Packaged medicaments demand has not slowed down after the pandemic. Effective regulatory systems and harmonization is being promoted by the African Union and its intra-trade networks to overcome small fragmented markets, enabling more local production with stronger procurement and delivery capabilities.

Transport and logistics:

A majority of the intra-Africa trade happens through land transportation, apart from the air and maritime transport from external importers. More investments are seen in building more robust train and highway infrastructure led by governments, as well as road construction that will increase the efficiency of land transport in fragmented destinations in sub-urban and rural areas.

Africa is gaining more attention from foreign investors and international importers. From mammoth investment in renewable tech and industrial facilities, to rapid development of internet connectivity infrastructure, the continent is pivoting to a modern lifestyle where consumers will be benefited from richer resources to improve their living standards. Beyond the highlighted sectors and trends mentioned above, there are more untapped import and business opportunities yet to be explored, where foreign investors can capitalize while contributing to Africa's development.

Sources: WTO, UNCTAD, WITS, ICDT, IFC, ITC, IMF, Word Bank, WEF, OEC, BACI (2021), AfCFTA, and many more governments' and NGO materials, etc.

Looking to import & export in Africa?

Meet our specialists to explore allocating investments or starting large-volume good trade in Africa.

Schedule a callHeadquarters: N'Djamena 🇹🇩

HQ address: Boulevard Du President N'Garta Tombalbaye BP:7469 N'Djamena, Chad

+235 64783674